Letter from the Chairman & CEOAlbert G. Lowenthal

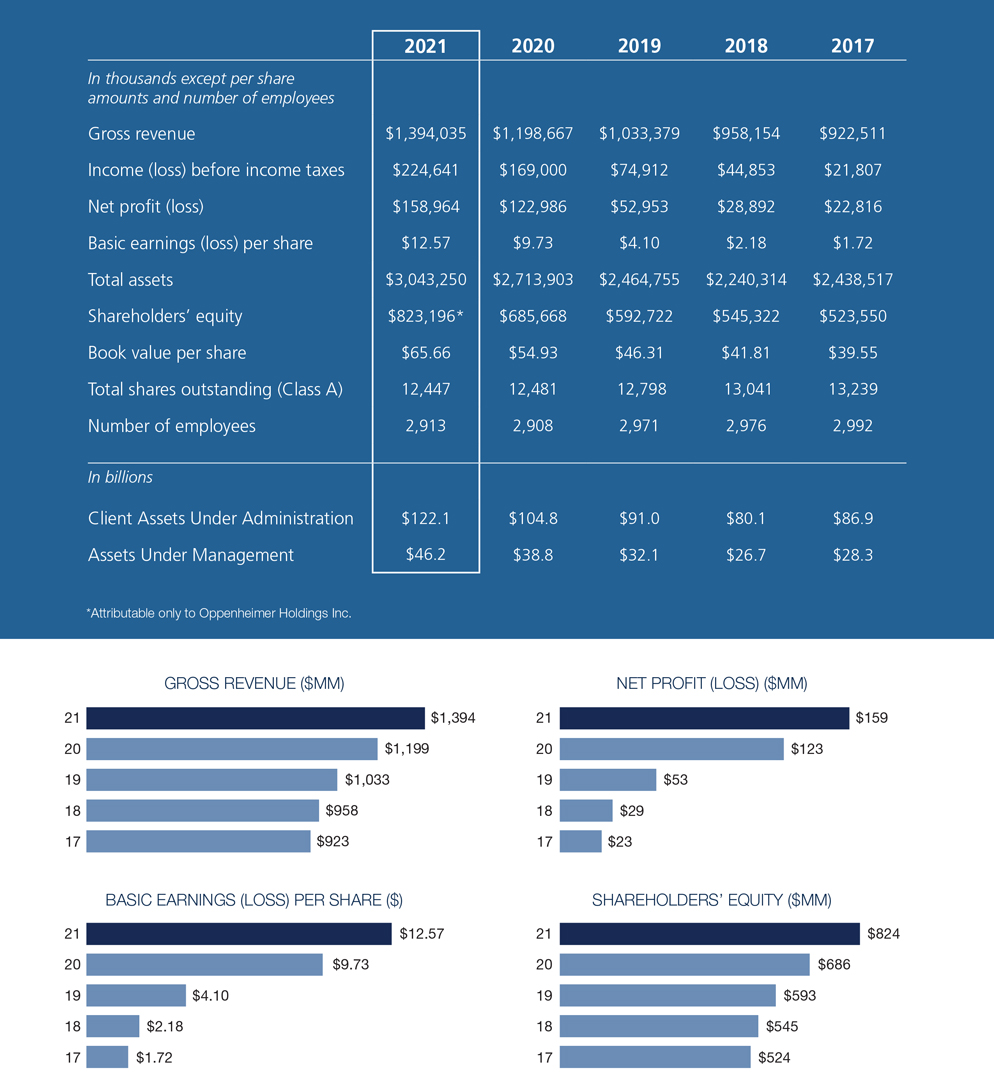

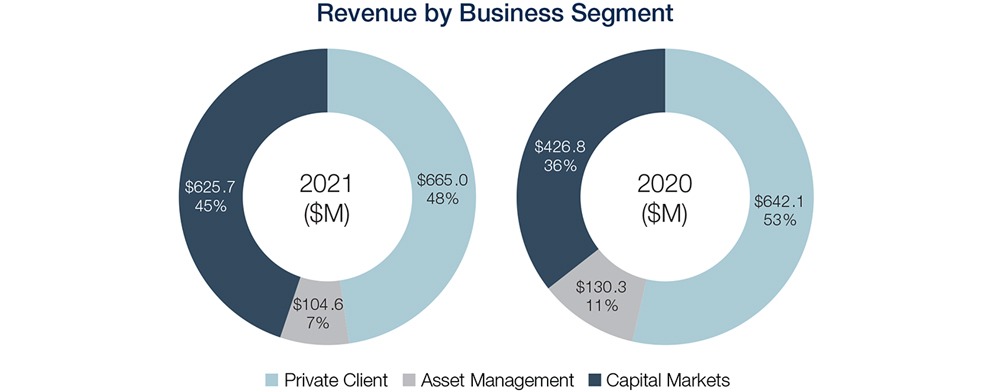

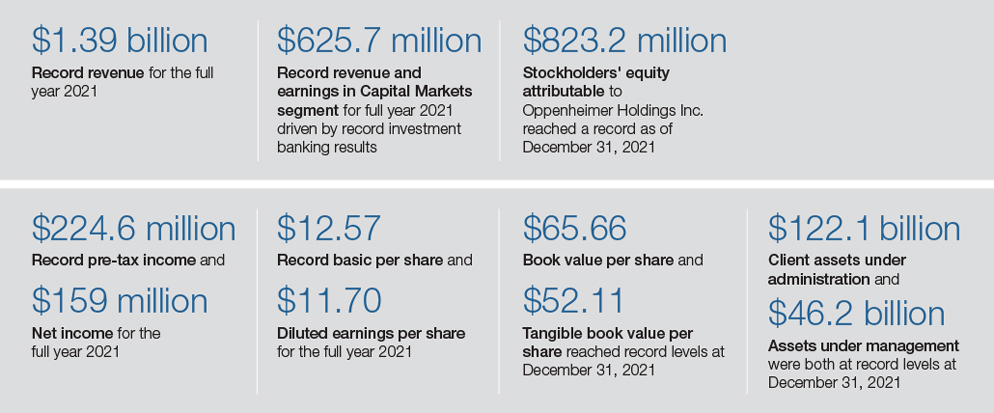

2021 was also a historic year for Oppenheimer as we celebrated our 140th Anniversary. Collectively, we achieved record results, set against a complex operating backdrop. Our unwavering belief in our purpose, our strategy, and our people provided Oppenheimer with the ideal moment to move forward across numerous fronts and succeed as never before. We are a firm that rises to challenges, recognizes opportunities, and empowers investors, families, entrepreneurs, and companies to achieve their financial goals and desired results. Our three principal business units – Capital Markets, Asset Management, and Private Client Services – individually delivered exceptional results. More importantly, our businesses are operating together in bringing synergies that benefit our clients, opening new opportunities for our firm, and ultimately, to our shareholders.

By prioritizing employees’ safety, health and well-being, we remained both safe and productive as we managed through the pandemic. Despite the difficult environment, we achieved much and produced another year of outstanding performance. Our employees have been both resilient and resolute, demonstrating an almost unlimited capacity for working differently, and an unwavering commitment to each other and to their clients. For the majority of the year, an overwhelming majority of our employees continued to work remotely or in a hybrid work environment as a result of robust business continuity planning and years of investment in our technology infrastructure.