November 2023

It seems that, for the most part, the debate about inflation is over. It was transitory after all. The big debate now seems to be when, and by how much, the Fed will lower rates.

With the Fed Funds rate anchored at 5 ½%, an inflation rate of 3% equates to a real interest rate of 2 ½%. And as inflation continues to fall, as expected, that real interest rate continues to rise with each CPI downtick. This is impactful, and may be the straw that breaks the economic camel’s back. We shall see. The market is currently expecting that the Fed will lower rates by June of next year. Some, like Bill Ackman in a Bloomberg interview this week, believe it will be by March as this added tightening will become evident to the Fed early next year. However, a simple and relevant question is this: when has the Fed ever been pro-active with monetary policy? The greater likelihood is that they will be slow to act. Hence a recession/growth scare seems logical…… an environment that favors bonds, bond proxies, defensive stocks like utilities, consumer staples, etc. In other words, all the things that did nothing in 2023 may come alive in 2024, at least the first part of it.

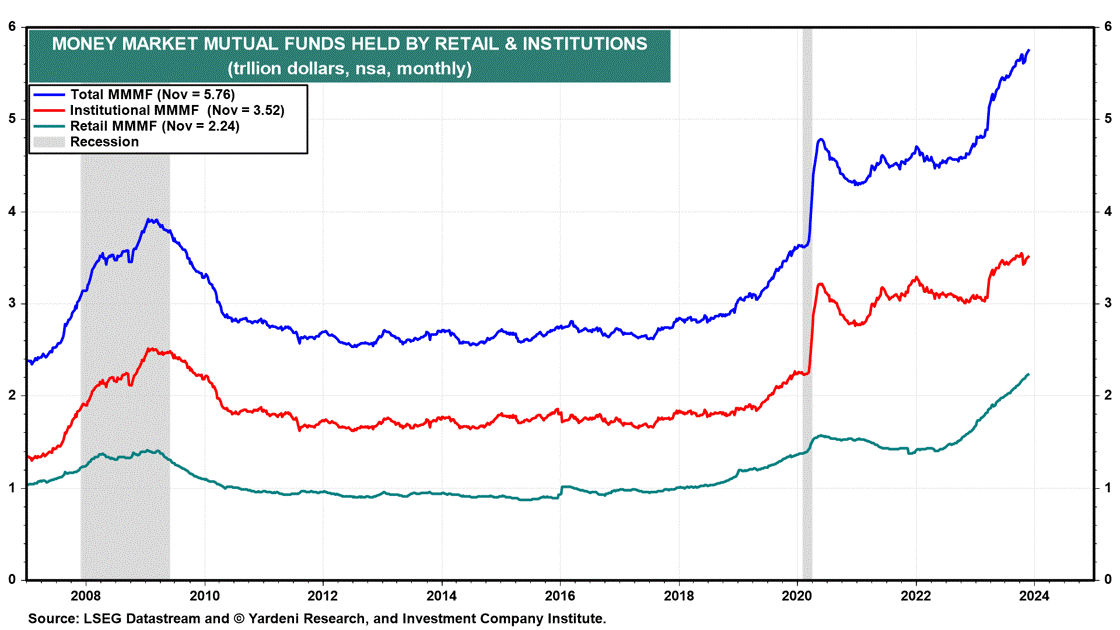

Investors should also begin to consider re-investment risk in the money markets. There’s a record $5.7T in money market mutual funds, and there’s also a lot of cash sitting in M2 bank deposits. Some of this money might move into stocks and bonds if depositors start to worry that rates are falling. Let me know when you’re free to discuss further.

The views expressed in this letter are those of the author and not Oppenheimer & Co. Inc. and are subject to change without notice. These views are not intended to be a forecast of future events or investment advice. The information and statistical information provided herein have been obtained from sources believed to be reliable, but in no way are warranted as to accuracy or completeness. Past performance is no guarantee of future results. The performance of an index is not indicative of the performance of any particular Investment; however, they are considered representative of their respective market segment. Oppenheimer Asset Management Inc. and Oppenheimer & Co. Inc. are both indirect wholly owned subsidiaries of Oppenheimer Holdings Inc.