Sector Scorecard

A breakdown of growth and value style performance by sector

Divergence between growth and value is nothing new. But the current disparity reminds us to dig deeper when looking at index performance. As market cycles evolve, analyzing sector returns and weights can be useful in explaining the divergence between growth and value styles. In other words, composition matters. The sectors with the highest weights and strong fundamentals have fueled index performance. Indeed, tech is now sitting at the top of the heap as rosy earnings growth forecasts and reasonable valuations have set the stage to drive returns higher.

Growth Heavy

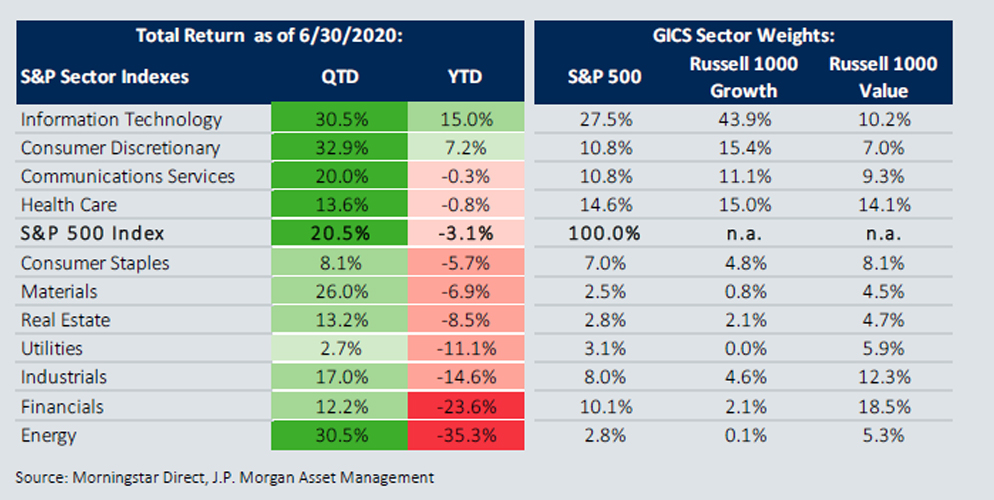

Technology and consumer discretionary have performed well relative to other sectors and now make up more than 38% of the S&P 500 and 59% of the Russell 1000 Growth Index.

Growth style performance has been dominated by four sectors. The four sectors that have outperformed the S&P 500 Index return over the year-to-date period—technology, consumer discretionary, communication services and healthcare—make up 85.4% of the Russell 1000 Growth Index and only 40.6% of the Russell 1000 Value Index. Within the S&P 500 Index, the four top-performing sectors year-to-date have a 63.7% weighting, and the seven underperforming sectors make up only 36.3%.

Value style performance has been broad-based. The seven sectors that have underperformed the S&P 500 Index over the year-to-date period make up 59.3% of the Russell 1000 Value Index and only 14.5% of the Russell 1000 Growth Index.

Divergence

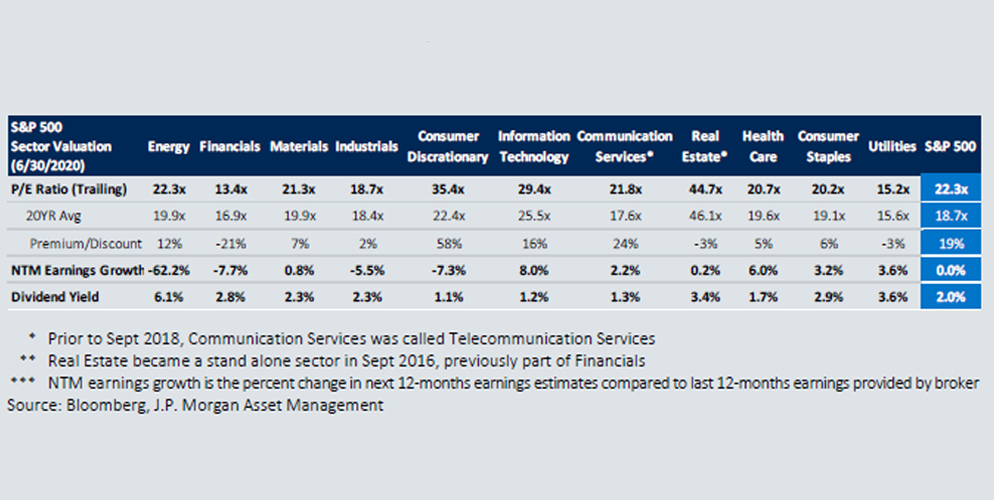

Earnings growth projections in tech and health care are strong at a time when earnings for most sectors have been revised downward but they remain at reasonable valuation levels.

Tech and health care offer reasonable valuations. In the S&P 500, technology and health care have higher expected earnings growth over the next 12-months but are not trading at substantial premiums. Financials offer the greatest discount relative to their 20-year average, yet it’s likely that historically low interest rates are creating a headwind by negatively impacting net interest margins on banks and insurers.

Consumer discretionary has struggled with the exception of two large companies. Given the bifurcated nature of consumer discretionary, a few performance winners drove the sector’s year-to-date performance, particularly Amazon and Home Depot, while the majority of sector constituents posted negative performance for the period.

Index composition has magnified the divergence between growth and value styles. If valuations and earnings growth levels are supportive of the current equity style performance, we may see these trends persist. However, investors may still find attractive value opportunities as energy and materials stocks rally off their lows.

This material is intended for informational purposes only. The information and statistical data contained herein have been obtained from sources we believe to be reliable. Oppenheimer Investment Advisers (OIA) is a division of Oppenheimer Asset Management Inc. Oppenheimer Investment Management is a subsidiary of Oppenheimer Asset Management. The opinions expressed are those of Oppenheimer Asset Management Inc.(“OAM”) and its affiliates and are subject to change without notice. No part of this material may be reproduced in any manner without the written permission of OAM or any of its affiliates. Any securities discussed should not be construed as a recommendation to buy or sell and there is no guarantee that these securities will be held for a client’s account nor should it be assumed that they were or will be profitable. Securities referenced herein are used as proxies or illustrations of broader market or sector principles. Past performance does not guarantee future comparable results.

All securities investing entails some risk of loss of principal. There is no guarantee the recommended strategy will be successful. Oppenheimer Asset Management is the name under which Oppenheimer Asset Management Inc. (OAM) does business. OAM is a registered investment adviser. A strategy's performance may be affected by general economic and market conditions, such as interest rates, inflation rates, economic uncertainty, changes in laws, and national and international political circumstances. The information provided herein should not be construed as a recommendation to buy, sell, or hold any particular security. Opinions expressed herein are current as of the date appearing in this material.

OAM is a wholly owned subsidiary of Oppenheimer Holdings Inc. which also wholly owns Oppenheimer & Co. Inc. (“Oppenheimer”), a registered broker/dealer and investment adviser. Securities are offered through Oppenheimer and will not be insured by the FDIC or other similar deposit insurance, will not be deposits or other obligations of Oppenheimer or guaranteed by any bank or other financial institution, will not be endorsed or guaranteed by Oppenheimer and will be subject to investment risks, including the possible loss of principle invested. 3179689.1