2025 Retirement Contribution Limits

As 2025 approaches, key cost-of-living adjustments (COLAs) for retirement savings plans and Health Savings Accounts (HSAs) will impact how individuals and employers maximize their contributions. These updates, effective for years beginning after December 31, 2024, provide the opportunity to optimize retirement and healthcare savings strategies.

IRA Contribution Limits:

For traditional and Roth IRAs, the contribution limit for 2025 remains at $7,000, with an additional $1,000 catch-up contribution for individuals aged 50 or older.

Increased Limits for SEP IRAs, Profit Sharing, and Money Purchase Plans:

- Contribution Maximum: Contributions to SEP IRAs, profit-sharing plans, and money purchase plans have increased to a maximum of $70,000.

- Compensation Cap: The maximum compensation considered for these contributions is now $350,000.

- With the contribution limit remaining at 25% of eligible compensation, individuals may qualify for the full $70,000.

Employee Contribution Maximums for 401(k), SIMPLE, 403(b), and 457 Plans:

- SIMPLE IRAs:

- Maximum salary deferral has risen to $16,500.

- Individuals aged 50 or older can contribute an additional $3,500, while those aged 60–63 are eligible for a $5,250 catch-up contribution.

- Employers with fewer than 25 employees allow slightly higher contributions of $17,600, with a catch-up of $3,850 for those 50 or older.

- 401(k), 403(b), and 457(b) Plans:

- The salary deferral limit is now $23,500, with the traditional catch-up contribution for those 50 or older remaining at $7,500.

- Individuals aged 60–63 can contribute an additional $11,250.

Pension Plan Limit History

401(k) Plan Limits for Plan Year:

Non-401(k) Related Limits:

Qualified Plan Compensation Limit:

Employers can consider up to $350,000 of an employee’s compensation when calculating contributions to qualified plans. For instance, if an employer contributes 10% of compensation, an employee earning $355,000 would receive a maximum contribution of $35,000 (10% of $350,000).

Highly Compensated Employee (HCE) Threshold:

The HCE threshold, which determines eligibility for certain plan testing, has increased to $160,000.

Defined Benefit Plans:

The annual benefit limit for defined benefit plans has risen to $280,000, providing greater flexibility for high-income earners planning for retirement.

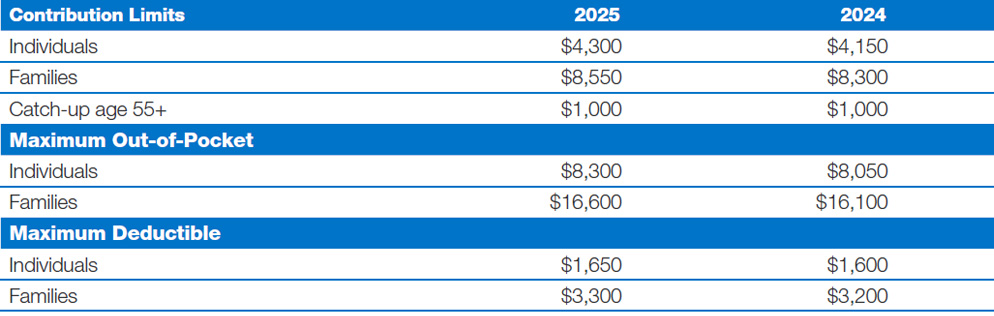

Health Savings Accounts (HSAs):

HSA contribution limits for 2025 will also see inflation-adjusted increases. These accounts remain a tax-efficient way to save for healthcare costs. The 2025 inflation adjusted indexed numbers for Health Savings Accounts (HSAs) are:

Employee Eligibility for SEP and SIMPLE IRAs:

- SEP IRAs: The income threshold for employee eligibility remains at $750.

- SIMPLE IRAs: The income threshold for eligibility is unchanged at $5,000.

Maximizing Your Savings Potential:

These COLA updates underscore the importance of proactive retirement and healthcare planning. Whether you’re an employee looking to maximize contributions or an employer designing benefits packages, these adjustments provide enhanced opportunities to save for the future.

To learn more, click here to view our document on 2025 Retirement Contribution limits.

For personalized strategies to take advantage of these updates, consult with an Oppenheimer financial professional to ensure your retirement and healthcare savings align with your goals. Find one in your area here.

© 2025 Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC 7358523.1. All Rights Reserved.

The information contained herein is general in nature, has been obtained from various sources believed to be reliable and is subject to changes in the Internal Revenue Code, as well as other areas of law. Neither Oppenheimer & Co. Inc. (“Oppenheimer”) nor any of its employees or affiliates provides legal or tax advice. Please contact your legal or tax advisor for specific advice regarding your circumstances. This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials.