December 2023

With the exception of the Magnificent 7, a significant chunk of the full year gains for stocks occurred in November-December. During this period, investors became less concerned about a recession and inflation, and more convinced that the Fed was done tightening. As a result, the advance broadened out to include the other 493 stocks in the S&P 500, not just the largest 7. This is something which we believe will continue in 2024.

“Optimism Abounds on Wall Street This Year” was the headline for a WSJ article this past weekend. It cited a survey conducted by BofA Securities in December that found fund managers more optimistic than in any month since January 2022; and we all remember what happened in 2022! Recall that at the beginning of 2023 the near universal consensus was a looming recession and bear market. So the fact that optimism is now back to Jan ’22 levels is certainly a concern. As the old saying goes, when all the experts agree on one thing, something else is going to happen. The guess here is that stocks spend a good portion of 1H24 consolidating/digesting 2023 gains, particularly the large cap stocks. We’ll see.

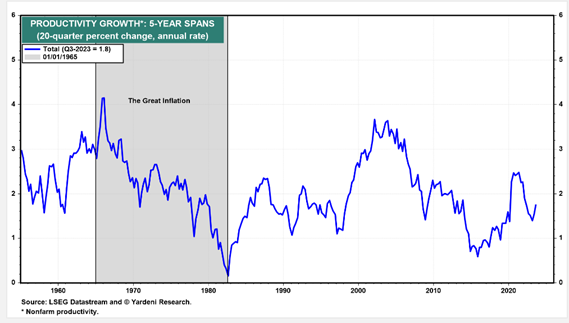

The good news is that the longer term promise of AI is likely to set off a productivity boom, which is already starting to unfold. It seems poised to address chronic labor shortages as investors begin to realize that the beneficiaries of AI aren’t just companies that make technology, but also those that use it to boost efficiencies. In other words, companies generally, whatever their industry may be. This seems enormously bullish for both the US economy and for the stock market.

Happy New Year!

The views expressed in this letter are those of the author and not Oppenheimer & Co. Inc. and are subject to change without notice. These views are not intended to be a forecast of future events or investment advice. The information and statistical information provided herein have been obtained from sources believed to be reliable, but in no way are warranted as to accuracy or completeness. Past performance is no guarantee of future results. The performance of an index is not indicative of the performance of any particular Investment; however, they are considered representative of their respective market segment. Oppenheimer Asset Management Inc. and Oppenheimer & Co. Inc. are both indirect wholly owned subsidiaries of Oppenheimer Holdings Inc.