April 2024

The April sell-off brought the six month stock market rally to an abrupt halt. During that time, the index gained 27.5%, so some consolidation of those gains seems natural. But the higher-for-longer inflation concern is still buffeting markets; and as growth appears to be slowing a bit, even stagflation fears have surfaced. Here are a few comments from prominent company leaders that I flagged during the month:

Blackstone COO Jonathan Grey: they own 230 companies, and 12,000 real estate assets. Grey said they are seeing inflation continuing to decline, although the pace has slowed. Input costs at their manufacturing co.’s are flat; rents are flat; hotel room revenues are flat, and in some cases, negative; and when they look at wages, these are running at +4% versus +5% a year ago.

Walmart CEO: “we are now seeing prices that are in line with where they were 12 months ago. I haven’t been able to say that for a few years. The last few weeks we’ve taken even more prices down in areas like produce, meat, and food.”

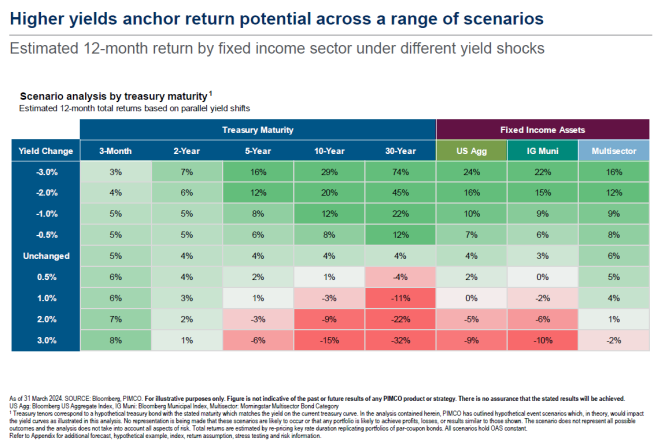

Our feeling has been that inflation is tracking a lot better than the official CPI statistics are showing. The Fed has made it clear they are done raising rates…..they may not be ready to cut, but once inflation resumes cooling, the Fed Funds target rate should fall. Exactly when this happens matters less than preparing for it in advance as markets tend to reprice very quickly. The aggressive play is small caps; the conservative one is bonds where the risk reward seems very attractive. See the below table, particularly the MULTISECTOR column on the right. Good outcomes for widely varied scenarios.

The views expressed in this letter are those of the author and not Oppenheimer & Co. Inc. and are subject to change without notice. These views are not intended to be a forecast of future events or investment advice. The information and statistical information provided herein have been obtained from sources believed to be reliable, but in no way are warranted as to accuracy or completeness. Past performance is no guarantee of future results. The performance of an index is not indicative of the performance of any particular Investment; however, they are considered representative of their respective market segment. Oppenheimer Asset Management Inc. and Oppenheimer & Co. Inc. are both indirect wholly owned subsidiaries of Oppenheimer Holdings Inc.