February 2024

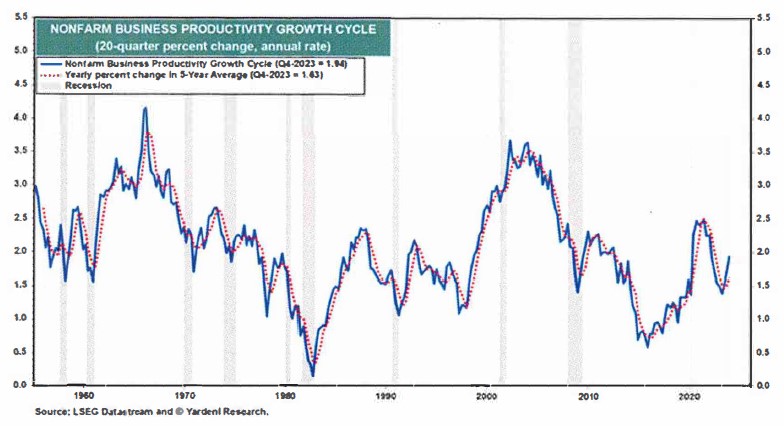

Although the "sticky" inflation argument is still embraced by many, the far likelier scenario is that we are entering a disinflationary and yield-peaking phase, which will be a strong tailwind for growth stocks, small caps, and sectors leveraged to interest rates. Add to this is a potentially powerful productivity cycle: chronic labor shortages (especially of skilled workers) will cause businesses to boost productivity; tech will enable the boost; and it could be a dramatic one. Last year's productivity gains were impressive, and this year is starting out with more gains to come. See below chart.

Of course, the jet-fuel for all this may be Al. As the NVidia conf. call on Feb 21 made clear, they believe the Al era is still just beginning. It is worth spending an hour to listen to that call NVIDIA Corporation (NVDA) Q4 2024 Earnings Call Transcript I Seeking Alpha, but here are the main takeaways: 1) For years we have been hearing about the roll out of SG and how much faster information will be transmitted. We have also observed the enormous amount of data being stored in the Cloud. The speed of NVidias GPU chips, together with Al, suddenly provide the vehicles to exploit all that groundwork. 2) Al may kick start an upgrade cycle in datacenters, computers, among others ... 3) According to Nvidias CFO, "virtually every industry" is building and deploying Al solutions. Companies from search to e-commerce, social media, news and video services, entertainment, software, automotive, healthcare, and financial services.

The productivity increases from all this could be profound, and may surpass those seen in the mid-90's.

Happy March!

The views expressed in this letter are those of the author and not Oppenheimer & Co. Inc. and are subject to change without notice. These views are not intended to be a forecast of future events or investment advice. The information and statistical information provided herein have been obtained from sources believed to be reliable, but in no way are warranted as to accuracy or completeness. Past performance is no guarantee of future results. The performance of an index is not indicative of the performance of any particular Investment; however, they are considered representative of their respective market segment. Oppenheimer Asset Management Inc. and Oppenheimer & Co. Inc. are both indirect wholly owned subsidiaries of Oppenheimer Holdings Inc.