March 2024

According to Renaissance Macro Research, the return difference between high momentum sectors and low momentum is in the 94th percentile. This seems obvious, as tech, AI-related, and Mag-7 stocks have dominated the performance these past 15 months. Research shows, however, that once the 90th percentile is breached, the market advance begins to broaden to include other sectors. A lot of things follow a dovish Fed: financial conditions ease; CEO confidence improves (impacting cap-ex, M&A, and IPOs); investors begin to unwind some of their cash hordes as interest rates fall; and lending standards ease. In short, the bull market strengthens.

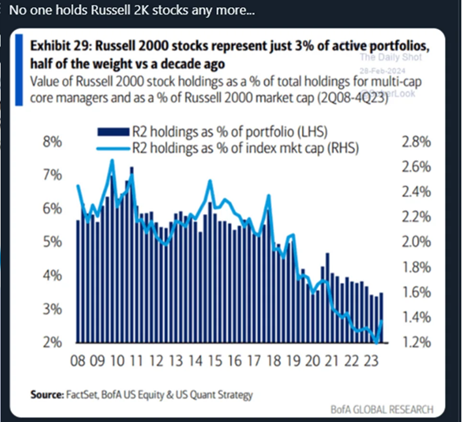

We expect small caps to be a major beneficiary of all this as the year progresses. The chart below is one of numerous reasons to consider this asset class: it is not owned. The chart confirms that investment manager holdings are at multi-decade lows, while the fundamentals are beginning to turn. Valuations put small caps at a 44% discount to large caps on price-to-book, and a 41% discount on PEs. This was the launching pad in 1999 for 12 years of outperformance.

The investment case for the rally broadening is clear: Fed tightening is over; easing is coming perhaps in June; and the glide path of inflation, while occasionally bumpy, is trending lower.

The views expressed in this letter are those of the author and not Oppenheimer & Co. Inc. and are subject to change without notice. These views are not intended to be a forecast of future events or investment advice. The information and statistical information provided herein have been obtained from sources believed to be reliable, but in no way are warranted as to accuracy or completeness. Past performance is no guarantee of future results. The performance of an index is not indicative of the performance of any particular Investment; however, they are considered representative of their respective market segment. Oppenheimer Asset Management Inc. and Oppenheimer & Co. Inc. are both indirect wholly owned subsidiaries of Oppenheimer Holdings Inc.