The Virtual Family Office (VFO): Simplifying Wealth Management

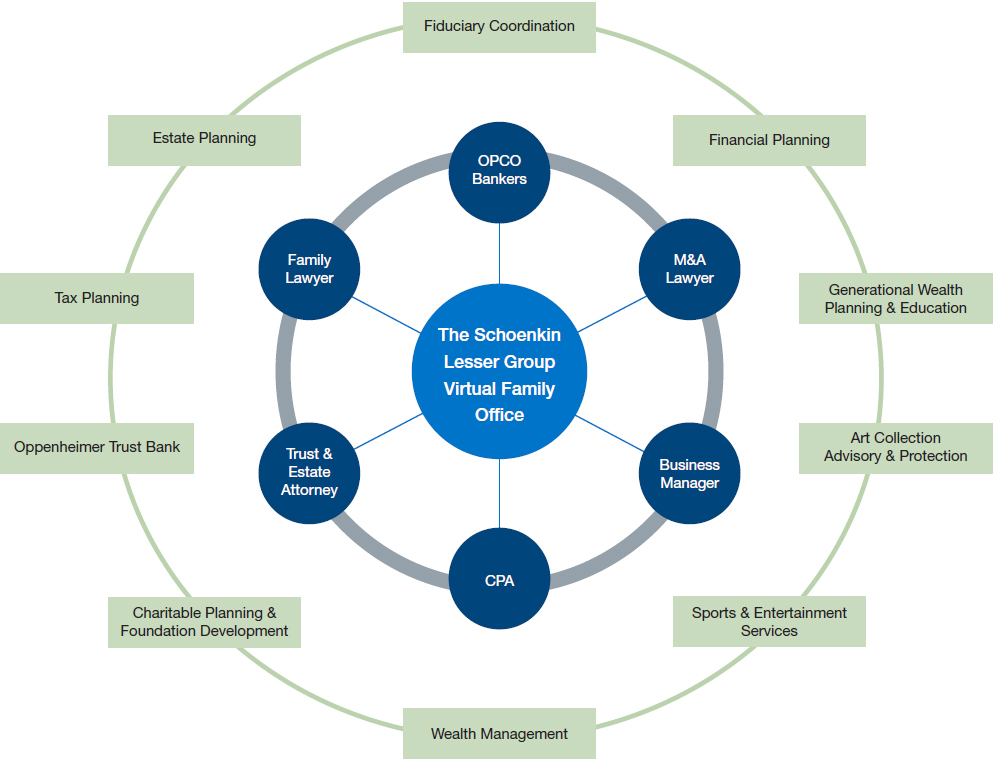

At the Schoenkin and Lesser Group of Oppenheimer & Co. Inc., we understand the challenges families and fiduciaries face when establishing a virtual family office. A Virtual Family Office (“VFO”) consists of a team of professionals who rather than operate in silos, collaborate seamlessly to provide a holistic wealth management experience, supported by well-defined governance, structure, and process. With 35 years of experience and close relationships with our clients' trusted advisors, we excel at building these virtual teams across multiple firms.

The VFO model is most effective for estates ranging from $20 million to $250 million. It offers numerous advantages, such as the ability to outsource specialized staff and engage dedicated partners when needed. This approach minimizes monthly overhead while ensuring access to necessary resources.

Another benefit is the cumulative strategy effect. Unlike single family offices, VFO teams draw on the collective wisdom of multiple families, sharing successful strategies and ideas. By solving an issue for one family, we can often apply the same method to others in similar situations, expanding the pool of strategies. The Schoenkin and Lesser Group leverages state-of-the-art technology and transparent pricing to structure and implement this process effectively.

In essence, a VFO brings together a family's existing professional advisors. The success of any VFO relies on shared values and disciplines, including transparency, collaboration, communication, authenticity, humility, and accountability. The Schoenkin and Lesser Group offers a value-driven strategy for families and fiduciaries who seek unbiased guidance.

What to expect from us:

- We work closely with your trusted advisors to build the virtual family office team.

- Our time-tested team has the experience and resources to provide objective advice during team construction.

- We remain impartial when selecting, interviewing, and hiring outside professionals.