Philosophy

In today’s world, the speed and uncertainty in the market reaches new heights every day. Clients need us to provide more than just an investment recommendation; they need us to protect their lifestyle. Here, at the Atlantic Group of Oppenheimer & Co. Inc. we understand what’s on your mind when it comes to planning for your financial future. Every successful company has a Chief Financial Officer managing their finances, so why shouldn’t an individual have similar leadership?

At other firms, clients may be just a number. When we started The Atlantic Group, we had a vision that we wanted to treat my clients like family. We have client relationships that go back over 35 years. We have watched children become parents, parents become grandparents, startups become corporations and lives become legacies. Our simple mission of putting the client first is the principle that guides this practice. We learn who you are and where you want to go long before we talk about investments. An exhaustive process of discovery is required if we are to completely understand your needs and your dreams. As one of the few remaining boutique investment firms, and our independence within Oppenheimer, we are uniquely suited for the one-on-one client relationship. From equities to fixed income, from domestic investments to offshore opportunities, we provide personalized investment solutions custom-tailored with you in mind.

We seek a deeper relationship for the long term, using a multi-generational approach to planning. Recently, it feels like most of the financial world and Wall Street sees managing people’s money as a right. We view it as a privilege. And it’s a privilege we are honored to have. When clients make the decision to work with us, we understand the responsibility that comes with managing a legacy that may have taken a lifetime to build. If there’s one thing we’ve learned from our decades of financial support, it’s that the future is always changing. As life changes for our clients, The Atlantic Group is with you today, tomorrow, and for the future.

Approach

|

Icon

|

Approach Step

|

|

|---|---|---|

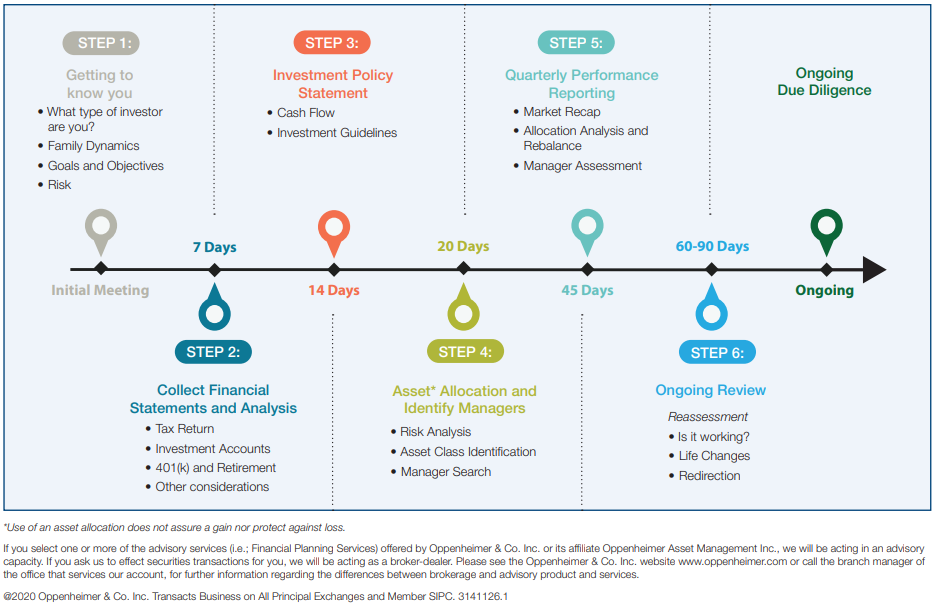

Discovery ProcessInvesting the time to learn about you and your family; your assets and liabilities. Our team strives to understand your goals and objectives which enables us to customize the relationship to your needs. |

||

Review Financial Statements and AnalysisBased on our review and analysis of your documents we determine your current asset allocation. Working with your tax and legal advisors, we help analyze your income and estate tax circumstances to identify and tailor planning techniques that help optimize your unique situation. |

||

Formulation of Customized Wealth Strategy and Financial PlanYour customized asset allocation reflects risk, opportunities and taxation across multiple entities, while integrating your investing and estate plans. |

||

Implementation of a Customized Asset AllocationAfter comprehensive due diligence and analysis of expected results across multiple market scenarios, strategies are chosen from our expansive investment platform |

||

Quarterly Review and Tactical Portfolio RebalancingReview performance of individual investment accounts and update financial plan. Adjust investment allocation to capitalize on temporary market distortions. |

||

|

Ongoing AssessmentIn collaboration with your other trusted advisors, we conduct ongoing reviews and comprehensive reporting to ensure that your strategy adapts to changing financial and family needs for future generations. |

Process