2024 Traditional and Roth IRA Contribution Limits

- November 20, 2024

As we approach the New Year, it is important to stay informed about 2024 contribution limits for Traditional and Roth IRAs. Being aware of these limits can help maximize retirement savings opportunities. Below is an overview on contribution limits, as well as Roth IRA eligibility income limits and Traditional IRA tax deduction eligibility income limits.

Contribution Limits:

For both traditional IRA and Roth IRA accounts, the maximum contribution limit is $7,000. The catch-up amount for individuals ages 50+ is $1,000. It is important to note that the contribution limit is the lesser of the dollar limitation or 100% of earned income.

Modified Adjusted Gross Income (MAGI):

To determine your ability to contribute to a Roth IRA, or your ability to make a deductible traditional IRA contribution, you will need to calculate your Modified Adjusted Gross Income (MAGI) by taking your Adjusted Gross Income (AGI) and adding back specific items, including:

- Foreign income

- Foreign housing deductions

- Student loan deductions

- IRA contribution deductions

- Deductions for higher education costs

It is important to note that Roth IRA conversion amounts are generally excluded from MAGI. Consider speaking with your tax advisor for assistance in calculating both your AGI and MAGI if you are uncertain of your amount.

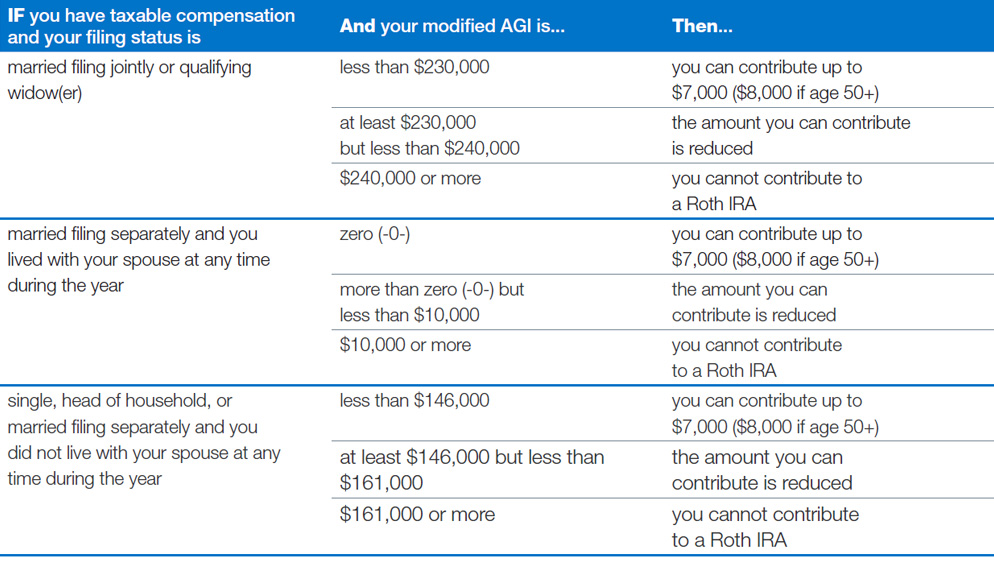

Roth IRA Eligibility Income Limits:

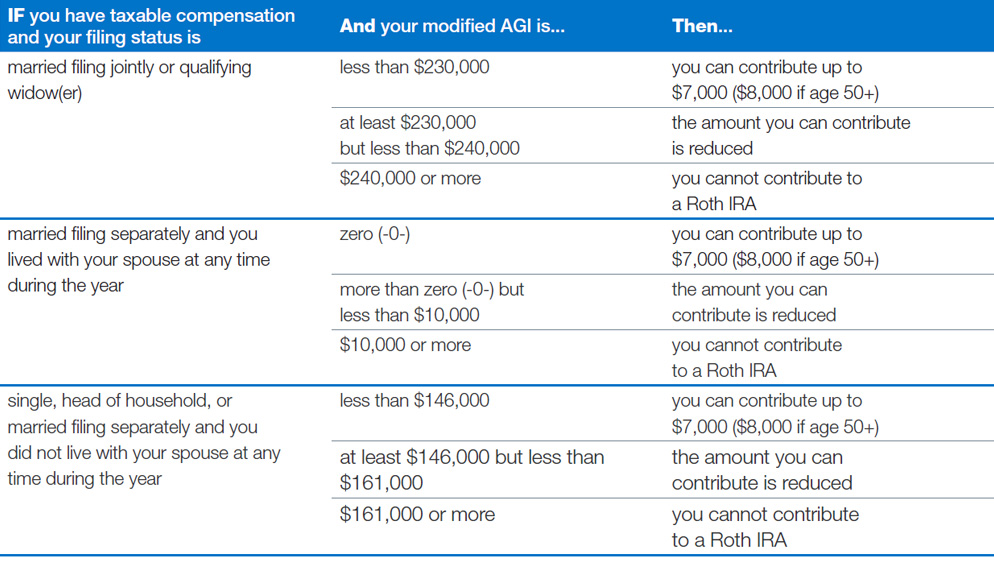

Traditional IRA Tax Deduction Eligibility Income Limits:

If you are covered by your employer’s retirement plan:

If you are not covered by your employer’s retirement plan:

To learn more, click here to view our document on 2024 Tradition and Roth IRA Contribution limits.

For personalized strategies to take advantage of these updates, consult with an Oppenheimer financial professional to ensure your retirement savings align with your goals. Find one in your area here.

DISCLOSURE

© 2024 Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC.7358509.1 All Rights Reserved.

The information contained herein is general in nature, has been obtained from various sources believed to be reliable and is subject to changes in the Internal Revenue Code, as well as other areas of law. Neither Oppenheimer & Co. Inc. nor any of its employees or affiliates provides legal or tax advice. Please contact your legal or tax advisor for specific advice regarding your circumstances. This material is not a recommendation as defined in Regulation Best Interest adopted by the Securities and Exchange Commission. It is provided to you after you have received Form CRS, Regulation Best Interest disclosure and other materials.