The Case for Allocating Capital to Fixed Income Today

- July 10, 2024

Investors seeking to preserve capital while generating a steady stream of income may consider the compelling risk/reward profiles offered by Investment Grade (IG) and Municipal bonds. These fixed-income securities provide attractive opportunities for conservative clients in the current market environment.

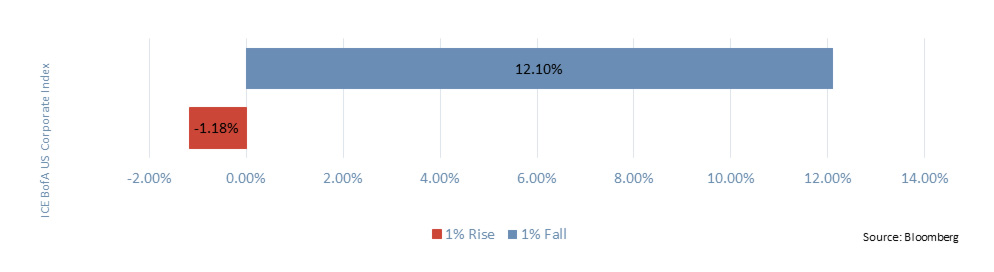

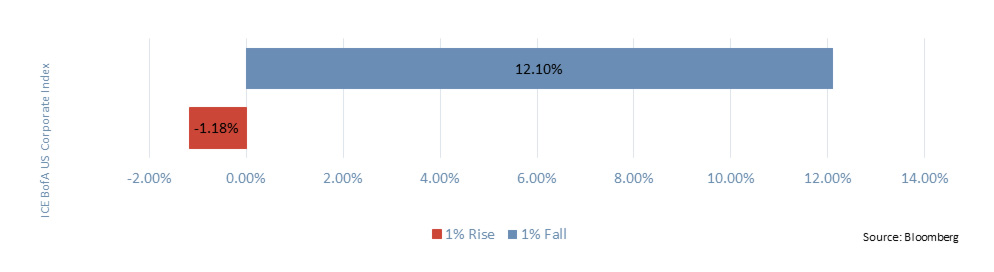

In today’s environment, the implications of a 1% rise or fall in interest rates on total return of the benchmark index may create a potentially beneficial opportunity for investors in the respective sector.

As of 6.28.24

Investment Grade Bonds

Asymmetric Return Potential: A 1% drop in interest rates could yield an impressive 12.1% return, highlighting strong upside potential.

Limited Downside Risk: If interest rates rise by 1%, the expected return impact is a modest -1.18%, demonstrating the defensive characteristics of these bonds.

Diversification: IG Bonds offer portfolio diversification benefits due to their moderate correlation with equities, with a correlation coefficient of 0.47 to the S&P 500. This diversification can help mitigate overall portfolio risk.

As of 6.28.24

Municipal Bonds

Attractive Upside in Declining Rate Environment: A 1% decrease in interest rates can lead to a 10.32% return, making them an appealing choice in a falling rate scenario.

Limited Downside Risk: A 1% rise in rates could potentially result in a return impact of -2.82%.

Diversification: Municipal bonds have a low correlation with equities, at 0.27 to the S&P 500. This low correlation helps in smoothing out volatility, making these bonds a strategic addition to a diversified investment portfolio.

As measured by the named index, the potential for significant returns in declining interest rate environments, combined with limited downside risk and diversification benefits, may make Investment Grade and Municipal bonds an attractive allocation.

Your Oppenheimer financial professional can serve as your guide to help determine where fixed income may fit into your asset allocation.

Source: Bloomberg. As of 6/28/24. Data reflects the approximate 1 year total return assuming 100 bps parallel shift in the yield curve.

Graphs are illustrations to show the effect of interest rate changes, and are not a projection of performance.

Oppenheimer & Co. Inc. does not offer tax advice; you should consult with your tax advisor regarding the suitability of tax-exempt investments in your portfolio. Income from municipals may be subject to federal, state and local taxes as well as the Alternative Minimum Tax. Municipal Securities are subject to gains/losses based on the level of interest rates, market conditions and credit quality of the issuer.

The Standard & Poor’s (S&P) 500 Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Individuals cannot invest directly in an index.

The ICE BofA U.S. Taxable Municipal Securities Index is designed to track the performance of USD-denominated taxable municipal debt publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. market.

The ICE BofA US Corporate Index is designed to track the performance of US dollar denominated investment grade rated corporate debt publicly issued in the US domestic market.

An investment grade is a rating that signifies a municipal or corporate bond presents a relatively low risk of default. Bond rating firms like Standard & Poor’s (S&P), Moody's, and Fitch use different designations, consisting of the upper- and lower-case letters "A" and "B," to identify a bond's credit quality rating.

The use of asset allocation does not guarantee a gain or protect against a loss.

Oppenheimer & Co. Inc. Transacts Business on all Principal Exchanges and Member SIPC 6738052.1