ANNUAL REPORT 2020 Public Finance

Year in Review

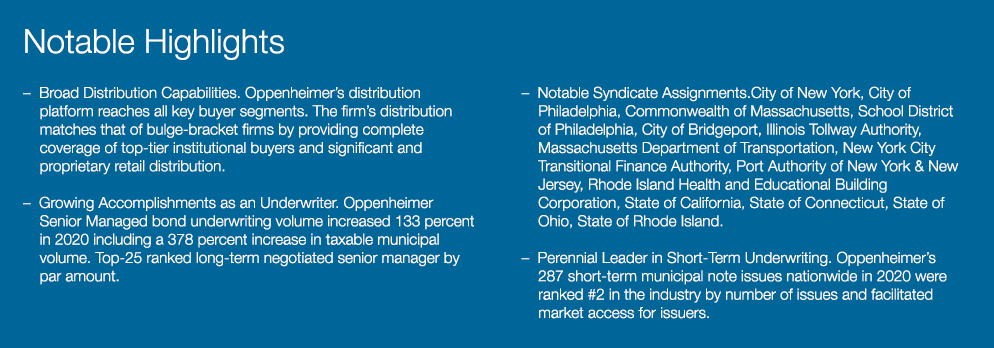

2020 was a high-watermark year for Public Finance in terms of revenue growth, transaction volume, league table rankings and departmental growth. The group finished the year with 56 banking, research, and sales and trading professionals dedicated to municipal finance. These professionals reside in 15 offices nationwide and provide our clients with localized banking expertise and broad distribution capabilities.

During the year, we closed on the acquisition of Brandis Tallman LLC, a leading specialist in the underwriting and placement of municipal debt for California issuers. The team brings a unique set of skills and experience directing the placement and origination of tax-exempt and taxable fixed income products. To seamlessly transition to our platform and retain their long-standing and well-established brand recognition in the market, the group will operate as Brandis Tallman, a division of Oppenheimer & Co. Inc.

Public Finance has restructured the department over the last few years—adding senior bankers to its ranks and reshaping the focus on education, healthcare, and senior housing, as well as expanding into public-private partnership (P3) infrastructure advisory and utilities with key hires. Due to our ability to educate buyers and place debt, issuers and their municipal advisors continue to rely upon our group to facilitate market access for issuers of all types and credit quality.

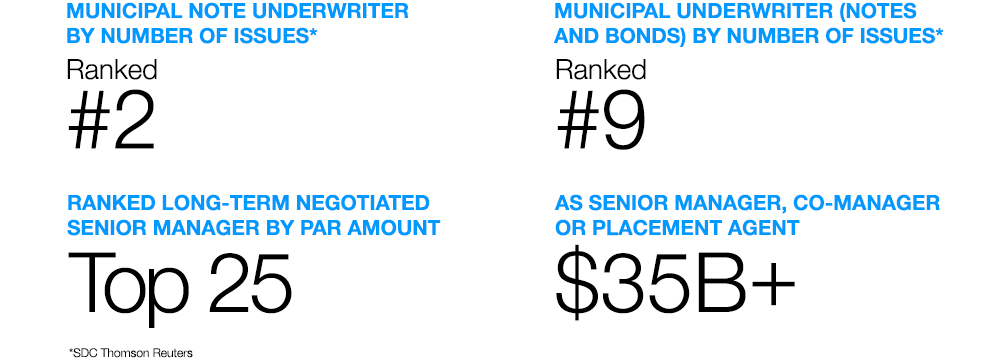

Oppenheimer served as Senior Manager or Placement Agent for 1,550 issues (bonds and notes) totaling over $12.5 billion since 2016 including $3.5 billion in 2020 and our largest taxable municipal offering to date—a $205 million Federal lease-backed bond. We continue to seek out co-manager roles to supplement our lead-managed activities—our group served as co-manager for 3,506 issues (bonds and notes) totaling over $154.3 billion since 2016 including $34.1 billion in 2020. We finished the year as a top-25 ranked long-term negotiated senior manager by par amount.

Our Senior Managed bond underwriting volume increased 133 percent in 2020 including a 378 percent increase in taxable municipal volume. Our taxable municipal work is driven by the Healthcare, Higher Education, Senior Housing and General municipal sectors. Oppenheimer launched two unique programs in 2020: Federal Lease Revenue Bond financing for key governmental assets, and a United States Department of Agriculture (USDA) long-term takeout financing structure. Both programs contributed to the significant taxable volume. In particular, we served as sole manager on $620 million in aggregate par of Taxable Federal Lease Revenue Bonds with significant excess demand on these transactions. Both programs carry market leader status and provide a steady flow of municipal bonds to our institutional and retail clients.

The firm continues to establish itself as one of the leading underwriters of short-term issues. In 2020, our note desk acted as underwriter on 280 short-term municipal issues, representing a 10.3 percent increase in issuance volume and finishing the year as the #2 ranked note underwriter by number of issues.

Looking Forward

2020 Transactions

-

Private Client Division

Read about the Private Client DivisionWhile managing through this pandemic, the division reported revenue of $642.1 million.

-

Asset Management

Read about Asset ManagementDespite our dispersed work environment, Asset Management delivered record-setting financial results.

-

Equities Division

Read about the Equities DivisionGenerating $168 million in top-line revenue, an increase of 56 percent, the business turned in the best performance since the financial crisis.

-

Investment Banking

Read about Investment BankingGross revenues reached $136.2 million, an increase of more than 70 percent, also marking the fourth consecutive year of revenue growth.

-

Taxable Fixed Income

Read about Taxable Fixed IncomeInstitutional business saw significantly more robust results, with increases ranging from 20 percent to 155 percent, across our various desks.

-

Public Finance and Municipal Trading

Read about Public Finance and Municipal Trading2020 was a high-watermark year for Public Finance in terms of revenue growth, transaction volume, league table rankings and departmental growth.