Diverging economic paths and healthier valuations overseas could catalyze a change in market leadership.

In Summary

Diverging economic conditions and healthier valuations overseas may lead to a changing of the guard, with international equities overtaking domestic equities as the market leader. Stabilizing or appreciating foreign currencies could enhance returns for U.S. investors in international equities, mitigating past headwinds from a strong dollar.

International developed equities are currently trading at discounts to U.S. stocks, and signs of economic recovery in Europe and Japan suggest a favorable risk/reward outlook.

Asset Class Change:

International Developed moved from slightly negative to neutral.

Slightly Negative to Neutral

For more information see the asset class detail below.

The United States was quick to recover from the depths of COVID-19, and the economy remained resilient even as monetary tailwinds turned to headwinds. Relative macro strength, significant fiscal stimulus, and the eventual tailwind from the emergence of generative artificial intelligence drove the dominance of U.S. equities over their international counterparts. Although OAM Research remains relatively cautious in our outlook for global equities, as the tides potentially begin to shift, international stocks could be poised for a rebound in relative performance. With investors typically maintaining a home country bias, OAM Research recommends considering diversifying equity exposure and increasing international allocations from slightly underweight to neutral positions.

International Opportunities

Historically, U.S. stocks have experienced extended periods of outperformance, but these strong market environments do not persist in perpetuity. There are signs that could be pointing to a potential shift in market leadership, and we observe several other factors that could drive superior returns for U.S. investors investing in international developed equities:

Dollar Momentum

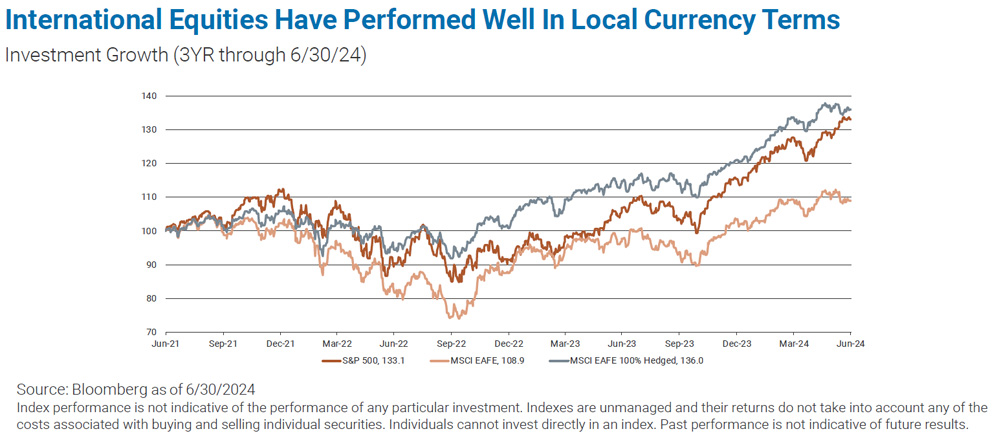

International equities have performed well in local currency terms. The MSCI EAFE 100% Hedged Index, which aims to strip out the currency effects, has performed in line with the S&P 500 over the last three years. Non-U.S. developed equities protected much better during the 2022 drawdown and mostly kept pace in the 2023 recovery. However, for U.S.-based investors, the dollar strength has notably hampered the returns of international stocks. The U.S. Dollar Index gained more than 5% over the last three years, rallying significantly as the Fed raised rates more aggressively than many other central banks. The more attractive U.S. Treasury yield, combined with the dollar’s safe haven status, led to the depreciation of most other major currencies such as the Euro and the Yen. If these currencies stabilize or even start to appreciate against the dollar, the currency headwind has the potential to become a tailwind for domestic investors in non-U.S. developed stocks.

Valuation Discount

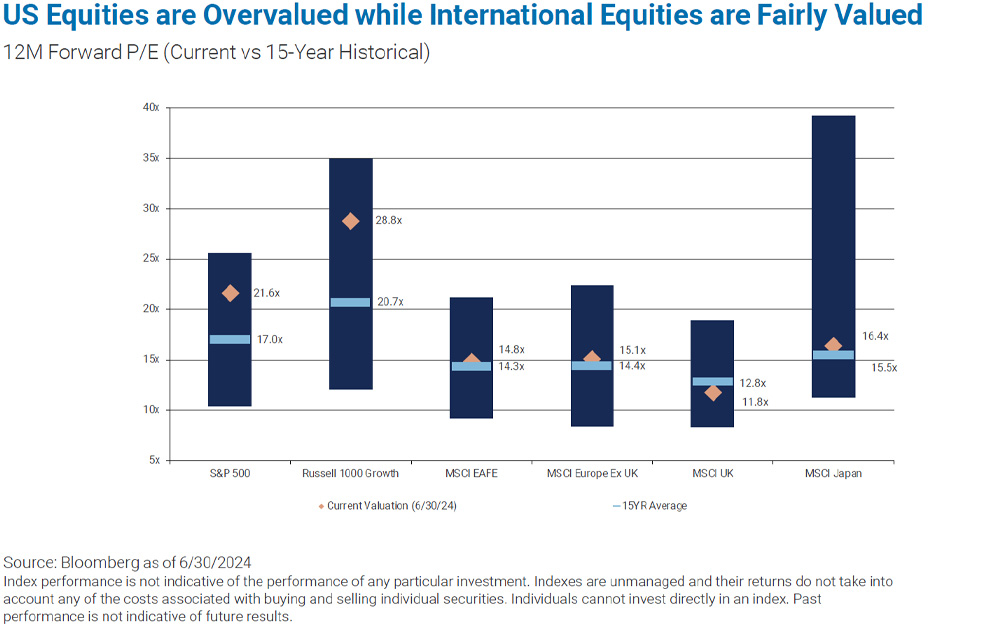

International developed equities trade at considerable discounts to U.S. stocks, despite valuations that are in line with longer-term averages. U.S. large cap indices, particularly the growth benchmarks, appear expensive after the significant appreciation of a number of heavily-weighted positions. Large cap growth equities are trading at a 37% premium to their 15-year average, while European and Japanese equities are trading at their 15-year average. In an environment where most risk assets are trading at rich valuations, reasonably priced non-U.S. developed market stocks appear to have a favorable risk/reward outlook.

Economic Divergence

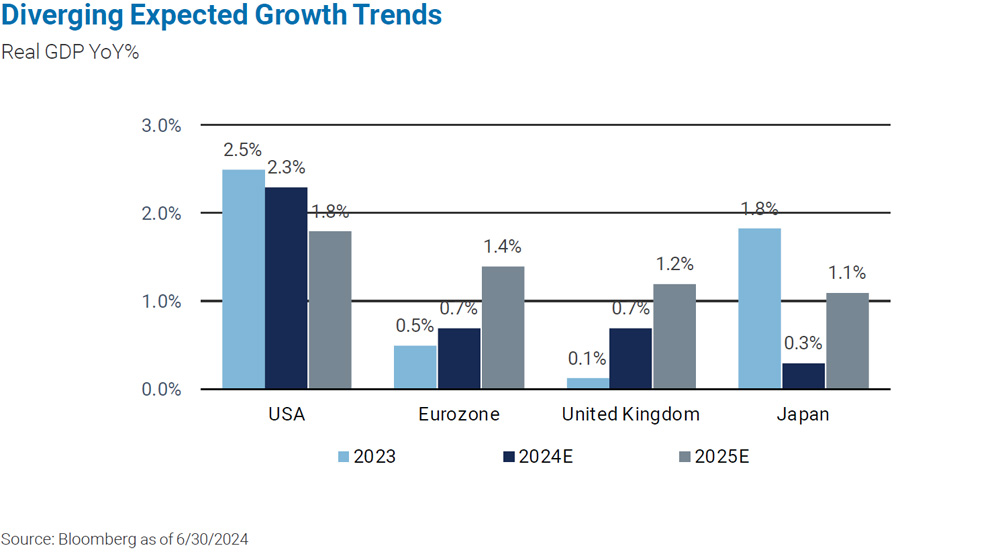

The U.S. economy has thus far weathered the combination of inflation and interest rate hikes, and even emerged much stronger than many expected. However, there are an increasing amount of cautionary signs that could indicate weakness on the horizon. Disappointing GDP growth in Q1, a weakening consumer, tighter lending standards, and a rising unemployment rate all point to a domestic economy that is cooling, albeit from robust levels.

By contrast, several European countries, including the U.K., experienced zero to negative GDP growth in 2023, and Japan’s economy was similarly weak in the back half of last year. These economies are more cyclical than the U.S. (and therefore more sensitive to rising interest rates), did not experience the same level of stock performance from AI compared to the U.S., and lacked the magnitude of fiscal spending that occurred domestically. However, more recent data show that growth may have troughed and that recoveries may be underway. If this positive momentum can be sustained, it may indicate the start of the next cycle for these regions.

Central Bank Divergence

Monetary policy is expected to be less restrictive overseas. The European Central Bank, as well as other central banks in the region, have begun to cut rates, and the Bank of Japan remains extremely accommodative. On the other hand, inflation in the U.S. has remained sticky, and the expectations for rate cuts domestically have been tempered. A more restrictive Fed should pressure U.S. equities, while non-U.S. stocks can benefit from some interest rate relief if other central banks continue to diverge.

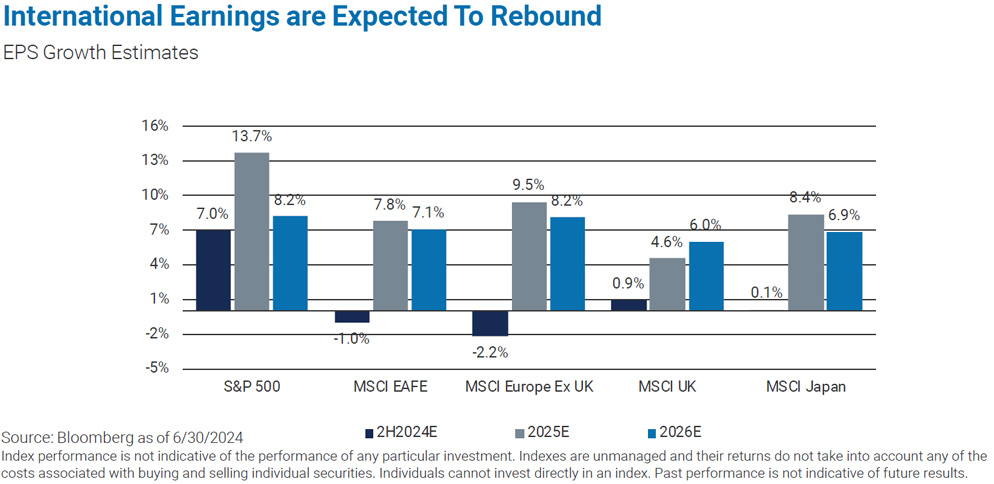

Earnings Growth Inflection

International corporate profits in recent years have been disappointing, as these businesses tend to be more cyclical, and earnings were curtailed by a pullback in spending overseas. In the U.S., meanwhile, staggering earnings growth from just a few large companies has masked more muted growth for the other areas of the domestic market. Going forward, international corporate profits are expected to rebound meaningfully.

Risks to our Outlook

In tandem with upgrading our outlook for International Developed Equities to neutral this quarter, it is important to consider potential risks that could be disruptive for global equities. There has been a downshift in global growth this year, and even if international economies remain on solid ground, a slowdown in other regions will likely have ripple effects across the world. Inflation has also remained stubborn in a number of areas, and if inflation remains above target it will limit how much room central banks have to cut. Outside of the macro picture, geopolitical risks also remain heightened, and escalations of existing foreign conflicts or upcoming elections could trigger more volatility.

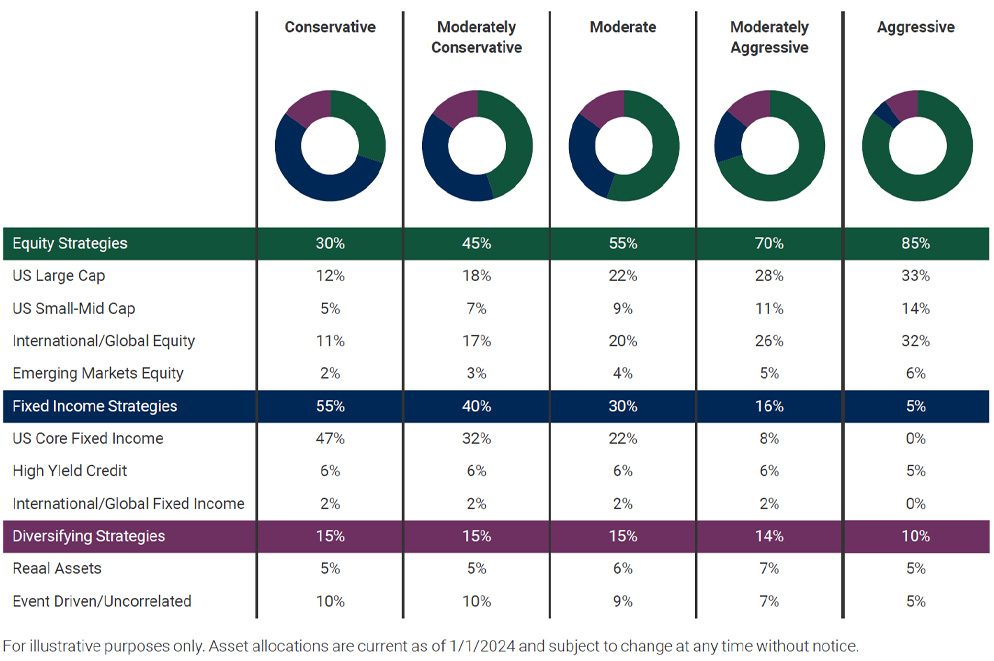

Given these risks, OAM Research remains relatively cautious in our allocation to and positioning within global equities overall, with neutral to slightly underweight allocations relative to our targets, and a bias towards higher quality strategies that should provide better downside protection in a more volatile environment. Investors should remain aware of potential concentration in portfolios to a given style, geography, or handful of stocks moving forward. We also continue to emphasize the importance of remaining diversified through allocations to high quality core fixed income and other diversifying strategies such as real assets and event driven, which continue to be attractive with interest rates remaining elevated, and could provide a cushion to portfolios in the event of a pullback in equities.

While this cycle of U.S. outperformance has been much longer than past periods, the stated potential catalysts could spark the broadening of market leadership to include international developed equities. Given that many investors’ portfolios are overweight to U.S. equities, we believe that now is an opportune time to revisit allocations and consider a rebalance to add more international exposure. Please refer to OAM’s Strategic Asset Allocations to identify an appropriate allocation to international equities based on your risk profile.

Asset Class Detail

The below outlines OAM Research’s macroeconomic and asset class views.

Global Equity

Large cap fundamentals appear healthy, though earnings growth outside of the mega-cap stocks has been more subdued. The market seems to be underappreciating tail risks such as sustained inflation or a slowdown in growth. Growth equity valuations remain very stretched, but value stocks are not as extended. Higher-quality companies with pricing power should be more resilient, and investors may benefit from allocating to strategies focused on quality and downside protection.

Small and mid-cap stocks are trading at significant discounts relative to large caps, and valuations appear reasonable on a historical basis. Smaller companies are facing the same headwinds as their larger counterparts, primarily due to the impact of higher interest rates, higher cost of labor and lending pressures but are navigating the environment with less diversified product lines. Smaller cap stocks tend to underperform as economic growth slows, so neutral positioning is warranted despite more attractive valuations.

While most major economies outside of the U.S. experienced weak growth in 2023, more recent activity data has begun to inflect higher. Central banks have made progress on inflation and have begun to cut interest rates, which may provide some relief to more cyclical markets. International equities continue to trade at meaningful discounts compared to U.S. stocks. Although a more pronounced U.S. slowdown could have global implications, we believe an underweight to international developed equities is no longer warranted.

Valuations remain reasonable and look attractive in our view relative to developed equities. China’s economy continues to face headwinds, but other emerging economies have been resilient. Active managers can seek to take advantage of bifurcated performance by allocating to countries with more promising growth prospects.

Global Equity - Alternatives

Long/Short Equity is considered part of the strategic asset allocation for equities based on each fund’s underlying investments.

We believe equity long/short strategies should benefit from increased dispersion and market dislocation, leveraging active management of both long and short positions. However, if a broad downward revision of earnings across sectors were to occur, it would likely adversely impact strategies.

Global Fixed Income

Interest rates remain elevated as the market repriced overly rosy expectations for rate cuts at the start of 2024. Sticky inflation may further delay Fed action, but we believe today’s yields offer attractive current income with significant capital appreciation potential when the Fed eventually moves. Investment-grade credit spreads are tight, but corporate balance sheets are generally healthy. In our view, spreads for high-quality securitized products represent attractive entry points.

Spreads remain tight and could be subject to meaningful widening if U.S. growth stalls. Defaults have picked up since 2022 and could accelerate if the economy worsens. Absolute yields today remain attractive, but the yield pickup relative to investment-grade doesn’t appear to adequately compensate for the extra credit risk.

Yields in most developed markets remain less attractive than U.S. yields, though international bonds may benefit from earlier central bank rate cuts. Emerging market debt looks more attractive within the non-U.S. market, both from a yield perspective and as a portfolio diversifier, though the asset class may suffer if global growth slows meaningfully.

Diversifying Strategies

Midstream energy infrastructure has remained resilient through a commodity reversal given strong fundamentals and elevated yields. Utilities can continue to benefit from thematic tailwinds relating to AI and clean energy, in our view. REIT valuations are attractive in our view and we believe the sector can outperform if interest rates are near their peak.

Event-driven strategies have rebounded from volatility in 2023 and continue to perform well as deals continue to see completion despite heightened regulatory scrutiny and deal flow has begun to recover. Managers with opportunistic credit exposure may additionally benefit from stressed and distressed situations that arise. Other strategies such as multi-manager continue to provide uncorrelated and steady returns with their ability to flexibly lean on multiple sub-strategies amid elevated volatility and higher rates.

Oppenheimer & Co. Inc. (Oppenheimer), a registered broker/dealer and investment adviser, is a indirect wholly owned subsidiary of Oppenheimer Holdings Inc. Securities are offered through Oppenheimer. If you select one or more of the advisory services offered by Oppenheimer & Co. Inc. (Oppenheimer) or its affiliate Oppenheimer Asset Management Inc. (OAM), the respective entity will be acting in an advisory capacity. Financial planning services are provided by Oppenheimer If you ask us to effect securities transactions for you, Oppenheimer will be acting as a broker-dealer. Please see the Oppenheimer & Co. Inc. website, www.opco.com or call the branch manager of the office that services your account, for further information regarding the difference between brokerage and advisory products and services. Trust services are provided by Oppenheimer Trust Company of Delaware, an affiliate of Oppenheimer. Diversified strategy investments such as natural resources, commodities or futures, real estate investment trusts (REITs), are made available by Oppenheimer only to qualified investors and involve varying degrees of risk. All information provided and opinions expressed are subject to change without notice. Neither Oppenheimer, Oppenheimer Trust Company of Delaware nor OAM provide legal or tax advice. However, your Oppenheimer Financial Professional will work with clients, their attorneys and their tax professionals to help ensure all of their needs are met and properly executed. Investing in securities involves risk and may result in loss of principal. There is no assurance any recommended strategy will be successful. Past performance does not guarantee future results.

© 2024 Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC. All rights reserved. No part of this brochure may be reproduced in any manner without the written permission of Oppenheimer. 6777984.1